Title : INFORMATIVE - Cash vs Currency

link : INFORMATIVE - Cash vs Currency

INFORMATIVE - Cash vs Currency

Money makes the world go around. We all accept this as truth, in a large part because it is. He who controls the right amount of money gains independence from the system - we see examples of this every day.But what IS money? Many don't stop to think of it in a literal sense. In terms of a realist. Money, as we know it today, is such a new concept in the timeline of human existence) that one could be forgiven for mistaking it as a "fad" of sorts - and really, that's precisely what it is. To understand large-scale global events fully, one must understand the workings of the global financial systems, such as the various stock markets. When analyzed, these markets seem immensely complex and convoluted, and in fact they are, so most people get overwhelmed and ignore it, only giving it cursory attention.

But to understand how money works, one must understand currency. A currency is a separate concept to money. A currency is a commodity of value. Value is a very subjective term, but there are many items of value which we all share, things such as food, water, oil, fabrics, wood and steel. These are all currencies because they are items which are required and thus have a value to someone. The more people see the commodity as something of use, the higher its value becomes. Much of the time, the rarity of a commodity is accounted for moreso than its use, as is the case with precious metals.

Money - in terms of dollars, rubles, baht, pounds or whatever your country uses, is known as a "fiat currency". A fiat currency is a form of currency which is purely representative of a "mass economy". A "mass economy" is the combined commodity structure of a country. So, the dollar coin in your hand is representative of a very tiny percentage of the combined commodity structure of your entire country.

Feels empowering, huh? That coin is your coupon which entitles you to your little slice of the country's wealth!

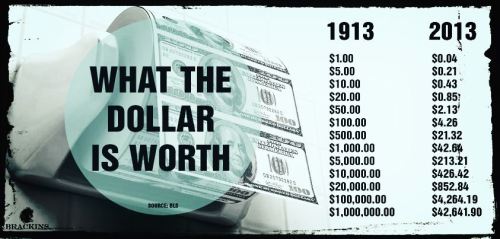

Only it's not. The description above lays out how it's MEANT to work, but unfortunately, it stopped working that way a very, very long time ago. It's worse in some countries more than others, but in general, there is something making that dollar coin worth less and less as time goes on. Inflation.

Inflation is an abstract concept which - and this is going to sound crazy - nobody understands. "Surely leading economists understand it, right?" I hear you ask. No. They don't.

The basic premise of inflation is that somehow, leading world nations have agreed to commercialize debt. The USA, as an example, spends more money as a country on imports (2.7 trillion) than it makes by exporting (2.2 trillion). There are also large problems with the internal economy of the country where top 1% earners in the country make and own more money than the bottom 99%, which means that one of the 1% holding a dollar is worth less than one of the bottom 1% holding a dollar. In a system of numbers this doesn't make sense, but in a system of CURRENCY this makes sense as it comes down to the VALUE of that dollar to the individual either spending it or seeking to earn it. This lop-sided system has led to a massive imbalance which means that the people making commodities feel justified in charging more and more for goods but the people buying them are making less and less, so the "value differential" grows, and increasing national debt means more and more money gets printed, lessening the value of the cash that is currently in circulation. If left unchecked, this can lead to a concept called "hyperinflation" - which is very dangerous.

People like to look at things like the "one hundred trillion dollar bills" in Zimbabwe and have a laugh, but that country had to be financially bailed out and do you know what the exchange rate ended up being? 250 trillion Zimbabwean dollars bought people ONE US DOLLAR, which has since been made the national standard currency. Their inflation rate at this time was 500,000,000,000%. People in the country were, quite literally, taking plastic bags filled with cash to the stores just to buy basics like bread and milk. That is the reality of hyperinflation and it is something which can happen again. Extrapolating current inflation data from the past 20 years shows that if things don't change, this will become a reality again in more countries, and hyperinflation comes with a lot of other side effects - often in the realm of civil unrest.

So how can someone become unaffected by money? By returning back to a mindset of "currency" rather than "cash". This means re-examining the concept of "value". Many people think of a savings account as a number sitting on a computer somewhere in a bank, representing how many dollars they have in that account. Other people prefer to hide a bunch of cash in a safe at home.

When you remove the concept of the fiat currency from the equation, a savings account might look like a warehouse filled with usable stock. Perhaps rolls of fabric, or pallets of steel or lumber. These are a great place to start in terms of a post-fiat currency system, but a stockpile like this can run out, be used up or perhaps even spoil over time or be stolen - or worse - taken from you by the government (put away the tinfoil hat, this has happened multiple times in the past and much closer to home than you'd think).

But what about an investment account? How would that look once you remove the concept of the fiat currency? Well, think of it like a stretched rubber band. What's it full of? Potential energy. That's how a commodity based savings account would work.

To clearly illustrate the concept, I will stick to one example of a valued commodity within a class of commodities: the tomato plant. Keep in mind this example is very simplified, but it's there to illustrate a point.

If I were to purchase 20 tomato seeds for $1 and germinate them, in a month I will have 20 tomato seedlings, each of which has the potential to be sold for $1 each. Say I were to sell 10 of them, but the other 10 don't sell before the plant reaches the adulthood stage. So I keep looking after those 10 remaining seedlings and they eventually turn into flowering adult plants. Each one is now sellable for $5. Say I only manage to sell half of them, which leaves me with 5 flowering tomato plants. If I put them into the ground and allow them to produce fruit, I could harvest approximately 25kgs of tomatoes. If I managed to sell half of them them at the current market rate of around $3 per kg I would be left with around 12kgs of fresh tomatoes, which I can then process down into sauces and pastes which can then be sold individually at around a dollar per 500mL jar. I can also take the oppourtunity to harvest a number of fresh seeds and repeat the process. By doing this, I have turned by initial $1 in cash into an approximately $100 yield and have no need to even invest a further dollar to repeat the process.

Now, the above example is very simplified. It ignores the fact that you must have horticulture skills, land to grow the plants, pots, fertilizer, water, etc, all of which are required to make this process work. But even taking a slice of the profits to cover these costs and playing it conservative, it illustrates the ability for "potential value". Governments can and have in the past come for people's money, whether it be in the form of cash, digital currency or physical goods stockpiles. But if you're growing a garden of plants and doing all of your trade cash-in-hand at markets, there is no record of the earning process taking place.

You can increase your yields by having more plants, more variety, good marketing skills, but the concept remains the same the entire time. One does not need to be dependent on fiat currency to get by.

The system also is not limited to plants. Having marketable skills can work much the same way, but this won't necessarily yield as much, there have been many accounts of Appalacians earning a solid living by using this system to brew moonshine in the mountains.

Anyway, it's something to think about. I hope that this has been enlightening to you.

- CumQuaT

Ok, this is the end of Article INFORMATIVE - Cash vs Currency

. The article INFORMATIVE - Cash vs Currency this can bring you positive energy and make you more intelligent with it.

You're now reading INFORMATIVE - Cash vs Currency with link https://theprepperhowto.blogspot.com/2016/03/informative-cash-vs-currency_18.html

0 Response to "INFORMATIVE - Cash vs Currency"

Post a Comment